Hi, I’m Sherille. I’m a Bestselling Author and Certified Mindset and Manifestation Coach for Divorced Women.

Divorce doesn't have to define you!

Rediscover Your Lost Spark

Reignite Emotional Strength, & Redesign a Life,

You Can’t Wait to Live.

Peace, love, joy and fulfillment is your birthright, and I want to make sure no one

and nothing steals it from you.

Hi, I’m Sherille. I’m a Bestselling Author and Certified Transformational Coach for High Performing Divorced Women.

Divorce doesn't have to define you!

Rediscover Your Lost Spark

Reignite Emotional Strength, & Redesign a Life,

You Can’t Wait to Live.

Happiness is your birthright, and I want to make sure no one and nothing steals it from you.

Feel Like Your Life’s on

Mute After Divorce?

It can be brutal.

One minute, you're planning vacations and family dinners; the next, you're staring down a mountain of

"what ifs" and a loneliness that chills you to the core.

Suddenly, the future you envisioned feels like a pile of dust. Loss of

income, loss of identity,

even the loss of friends you thought were "ours."

Heartbroken, confused, anxious, angry, and terrified –

may be your new normal.

You're just left there on your own to face…

Rediscover Your Lost Spark

Social Awkwardness

Grief for the Future

Doubts About Yourself

It can be a lot to process!

I know because I’ve lived that, too.

Lost in the post-divorce aftermath, thinking if happiness would ever be an option again. Especially if you've been married for

10, 15, 20 years or more,

rebuilding a new life can feel like starting from scratch.

But no one tells you this: your happiness isn't tied to your relationship status.

You are your own person.

Remember the smart, confident, and ambitious woman you were before?

She's still there, maybe a little bruised, but definitely not broken. You've conquered challenges and achieved goals

on your own before, haven't you? This is no different.

You are capable of incredible joy, strength, and fulfilment, regardless of what anyone says or does.

Your happiness is waiting to be rediscovered,

and you have the power to create a future that feels a breadth of fresh air – even after divorce.

As Seen In

My Story

Hello, I’m Sherille!

Chances are you’re here from my Instagram, maybe read a featured article or podcast about me somewhere, or perhaps a friend who's been there for you casually mentioned my story (thanks, friend!). Whatever the reason, I'm so glad we’ve finally met.

See, when I say I've been in your shoes, I genuinely mean it (been there, done that, got the emotional baggage!).

I used to think facing my child's cancer diagnosis while pregnant was the ultimate test. But divorce? It's a different kind of hurt. It shakes your whole world and forces you to rethink your life choices.

My story isn't all sunshine and rainbows. After being divorced, I was a mess. Gained a whopping 28 pounds in just 8 months (stress does crazy things), completely unaware of what’s happening around, and clung to the wreckage of my old life.

But deep down, I knew I couldn't stay like this. So I did what any stubborn, determined woman would do: I picked myself up, used all that pain as fuel, and began my self-improvement journey.

Invested in many therapies, online courses, and mentorship, and even explored some unconventional healing methods.

Prioritized

Prioritized my health, starting with small changes like nutrition-rich meals and gentle exercise routines.

Rebuilt my support system. Some friendships faded during the divorce, but the true ones grew stronger.

Forgave others and, more fundamentally, myself. It wasn't easy, but it was necessary to move on.

Reconnected with my passions. Buried under the stress, all my interests had faded.

This self-discovery wasn't linear.

There were setbacks and moments of doubt, but I kept pushing.

Today, I'm a healthier, happier, and more confident version of myself

But most importantly, I'm a proud mom, an "thought leader,author," and a successful

post-divorce transformation coach.

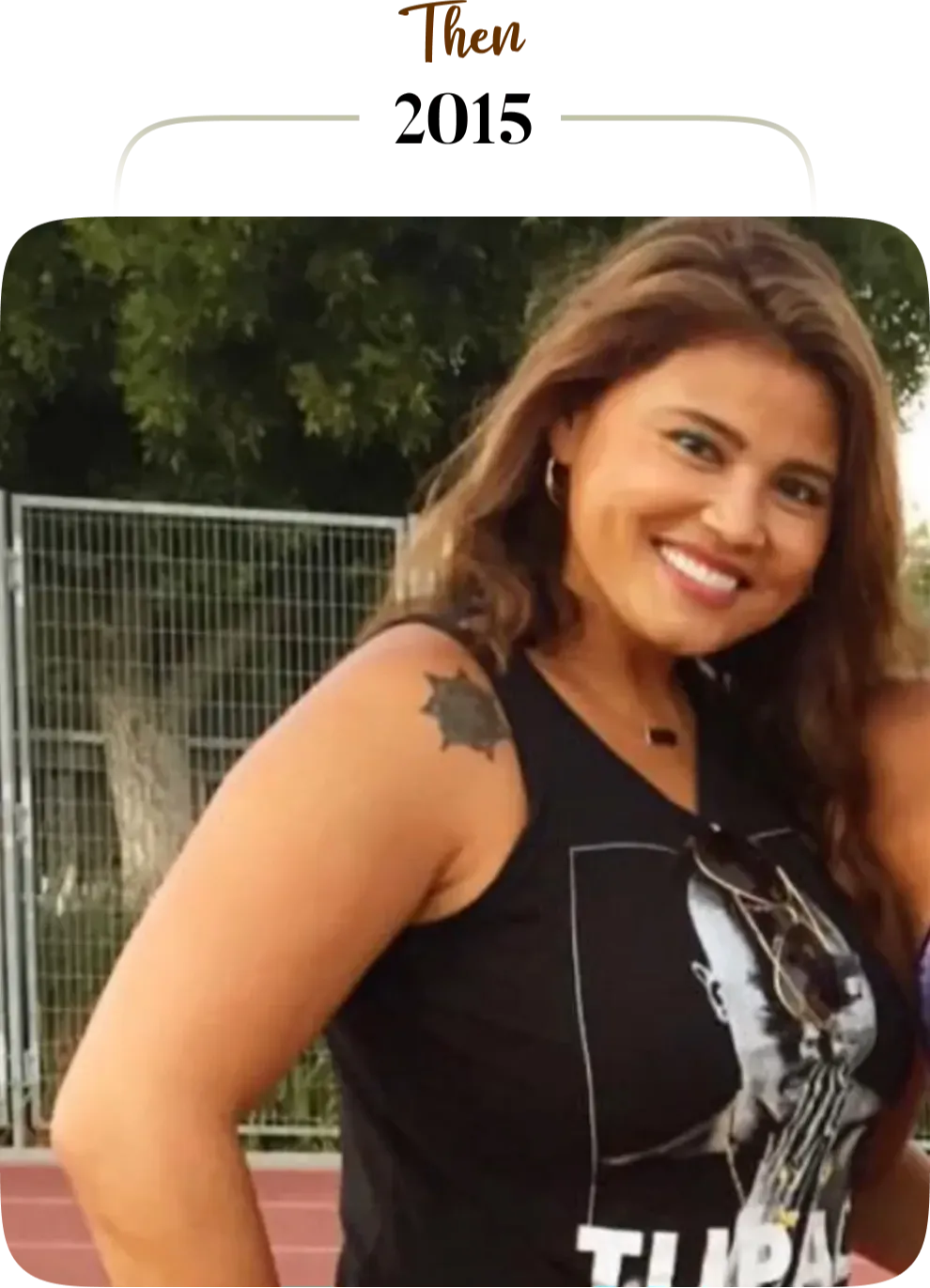

Age 36. Divorced, Single Mom, and Blindsided.

Felt Clueless, Miserable, and Afraid All the Time.

Struggled with Basic Financial Expenses.

Gained 28 lbs in 8 Months (YIKES!)

Age 45. Healed from the Past Trauma, Self-Loving, Empowered, and Raising Independent Young Men

Discovered Mental Strength, Clarity, and Inner Peace.

Founder of a Successful Coaching Practice and Thought Leader in My Industry.

Body in Healthy Homeostasis. Feeling and Looking Fantastic!

After reinventing myself, I realized my journey wasn't just about me. It was about supporting countless other women facing the same storm of divorce.

Traditional therapy can be great, but sometimes you need more. You need someone who's walked the walk, who truly gets the emotional rollercoaster, the heartbreak, the identity crisis, and the never-ending self-doubt.

That’s why I decided to use my real-world experience,

the lessons learned, and the tools I gathered on my journey (think empirical-based science, spirituality, alternative healing modalities) to help other divorced women silence their inner critic, shatter emotional blocks, and ultimately become a creator of their new lives – all while falling in love with themselves again.

Free Resources

Guides, worksheets, and training to jumpstart your healing journey and offer a burst of inspiration. On the house!

She Thrives Academy

A 12-week transformation journey thoughtfully designed to take you by the hand, guiding you from your post-divorce reality to the life you truly desire.

Private 1:1 Coaching

Get personalized support, mentorship, and action plans for your unique situation in these exclusive one-on-one sessions with me.

Love Notes

From Clients

Sherille has been my rock through the most challenging time of my life after divorce. Her coaching has been instrumental in helping me rebuild my confidence and rediscover my identity. With her guidance, I've learned how to be the best parent I could be. I now have more awareness. Sherille's sessions are a breath of fresh air. She is insightful, gives me clarity and perspective when I need it most.

Emily S.

Before working with Sherille, I struggled with feelings of unworthiness and self-doubt. But with her guidance and support, I've learned to see my own worth again. Her sessions have helped me get my confidence back and rediscover my value. Thank you, for giving me hope once again, Sherille!

Natalie R

I can't say enough about how Sherille's coaching. I could not have done the post-divorce journey without her guidance. I was so lost and stuck, but now I have excitement and purpose again. Through our sessions, I've not only learned to love myself but also become the person I needed to attract my healthiest relationship yet. Sherille's wisdom has helped me navigate challenges and rediscover my love for life.

Olivia G.

“The coaching sessions have given me great tools on becoming a better mother, wife and just to be good to myself. Sherille does a great job in helping me become more present. The awareness that I experience during our sessions is a gift that I have been wanting for past 10 years. The goals we set up every week have been so helpful in finding balance and achieving my goals. If you are ready to attain what you've been wanting and ready to change your life, book a consultation/session with Sherille. Her passion, commitment and knowledge will guide you there.”

Marie W

“Sherille has always demonstrated nothing short of excellence and I know for all of her clients that will be changed and impacted as I did then, now and going forward. I promise all can rest assured Sherille will Go above and beyond to make a fulfilling difference in each and everyone of her clients life.”

Kari H.

“I struggle with anxiety and stress. Hypnotherapy allowed me to improve my overall well-being and focus. The experience for me was life-changing and made a significant impact on my mental health. I always leave calm and relaxed. Thank you, Sherille, for your help and guidance.”

Daniella

“Thank you Sherille for your help. You always like an Angel go to my life. You helping me to resolving my difficult situation. Appreciate for your work.”

Angela

“I was facing a challenging time in my life and my experience with Sherille was mind opening. She performed reiki and a hypnotherapy session with me and it felt like a time traveling experience. It took me back to my past and help me gain perspective on things I needed to work through and see from the macro level. I recommend Sherille Marquez with your spiritual healing and her positive energy is a true blessing.”

Kristine D.

Sign Up for She Thrives Newsletter

Be the first to know about upcoming workshops, new programs and resources, early-bird discounts, and all the good stuff. Unsubscribe anytime!